Chapter 3

1.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .Graph out the production possibilities frontier:

b .What is the opportunity cost of apples in terms of bananas?

5.1=Lb

La a a c .In the absence of trade, what would the price of apples in terms of bananas be?

In the absence of trade, since labor is the only factor of production and supply decisions are

determined by the attempts of individuals to

maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =

2.Home is as described in problem 1. There is now also another country, Foreign, with a

labor force of 800. Foreign ’s unit labor requirement in apple production is 5, while in banana production it is 1.

a .Graph Foreign ’s production possibilities frontier:

b .

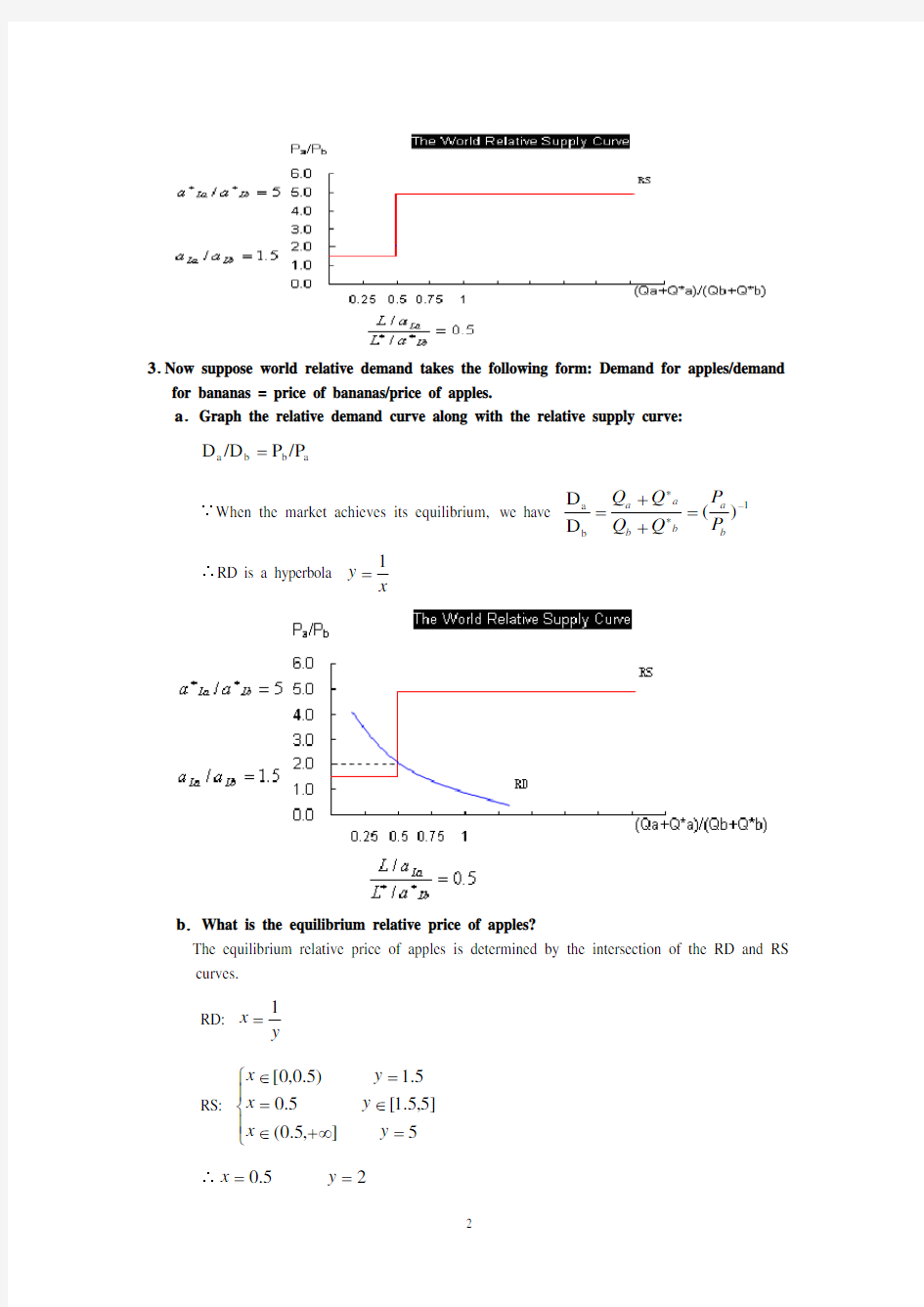

3.Now suppose world relative demand takes the following form: Demand for apples/demand for bananas = price of bananas/price of apples.

a .Graph the relative demand curve along with the relative supply curve:

a b b a /P P /D D =

∵When the market achieves its equilibrium, we have 1b a )(D D -**=++=b

a b b a a P P Q Q Q Q ∴RD is a hyperbola x

y 1=

b .What is the equilibrium relative price of apples?

The equilibrium relative price of apples is determined by the intersection of the RD and RS

curves.

RD: y

x 1= RS: 5]5,5.1[5

.1],5.0(5.0)5.0,0[=∈=??

???+∞∈=∈y y y x x x

∴25

.0==y x

∴2/=b P a P e e

c .Describe the pattern of trade.

∵b a b e a e b a P P P P P P ///>>**

∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.

d .

Show that both Home and Foreign gain from trade.

International trade allows Home and Foreign to consume anywhere within the colored

lines, which lie outside the countries ’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.

4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case? RD: y

x 1= RS: 5]5,5.1[5

.1],1(1)1,0[=∈=??

???+∞∈=∈y y y x x x

∴5.132==

y x ∴5.1/=b P a P e e

In this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.

5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?

In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.

6.”Korean workers earn only $2.50 an hour; if we allow Korea to export as much as it likes to the United States, our workers will be forced down to the same level. Y ou can’t import a $5 shirt without importing the $2.50 wage that goes with it.” Discuss.

In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. So

this pauper labor argument is wrong.

7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?

The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their U.S. counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.

9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?

Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.

10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)

Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.

Chapter 4

1. In the United States where land is cheap, the ratio of land to labor used in cattle rising is

higher than that of land used in wheat growing. But in more crowded countries, where land is expensive and labor is cheap, it is common to raise cows by using less land and more labor than Americans use to grow wheat. Can we still say that raising cattle is land intensive compared with farming wheat? Why or why not?

The definition of cattle growing as land intensive depends on the ratio of land to labor used in

production, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries too if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. The comparison between another country and the United States is less relevant for answering the question.

2. Suppose that at current factor prices cloth is produced using 20 hours of labor for each

acre of land, and food is produced using only 5 hours of labor per acre of land.

a. Suppose that the economy ’s total resources are 600 hours of labor and 60 acres of

land. Using a diagram determine the allocation of resources.

5T F LF /TF LF /QF)(TF / /QF)(LF aTF / aLF 20TC LC /TC LC /QC)(TC / /QC)(LC aTC / aLC =?===?==

We can solve this algebraically since L=LC+LF=600 and T=TC+TF=60. The solution is LC=400, TC=20, LF=200 and TF=40.

b. Now suppose that the labor supply increase first to 800, then 1000, then 1200 hours.

Using a diagram like Figure4-6, trace out the changing allocation of resources. Labor Land Cloth

Food

LC

LF TC

TF

t o n ).

s p e c i a l i z a (c o m p l e t e 0.LF 0,TF 1200,LC 60,TC :1200L 66.67LF 13.33,TF 933.33,LC 46.67,TC :1000L 133.33

LF 26.67,TF 666.67,LC 33.33,TC :800L ===============

c. What would happen if the labor supply were to increase even further?

At constant factor prices, some labor would be unused, so factor prices would have to change, or there would be unemployment.

3. “The world ’s poorest countries cannot find anything to export. There is no resource that

is abundant — certainly not capital or land, and in small poor nations not even labor is abundant.” Discuss.

The gains from trade depend on comparative rather than absolute advantage. As to poor countries, what matters is not the absolute abundance of factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.

4. The U.S. labor movement — which mostly represents blue-collar workers rather than

professionals and highly educated workers — has traditionally favored limits on imports form less-affluent countries. Is this a shortsighted policy of a rational one in view of the interests of union members? How does the answer depend on the model of trade?

In the Ricardo ’s model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries.

In the Immobile Factors model labor may gain or lose from trade. Purchasing power in terms of one good will rise, but in terms of the other good it will decline.

The Heckscher-Ohlin model directly discusses distribution by considering the effects of trade on the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits.

5. There is substantial inequality of wage levels between regions within the United States. Labor Land Cloth

Food

0l 800 0l 1000 0l 1200

For example, wages of manufacturing workers in equivalent jobs are about 20 percent lower in the Southeast than they are in the Far West. Which of the explanations of failure of factor price equalization might account for this? How is this case different from the divergence of wages between the United States and Mexico (which is geographically closer to both the U.S. Southeast and the Far West than the Southeast and Far West are to each other)?

When we employ factor price equalization, we should pay attention to its conditions: both countries/regions produce both goods; both countries have the same technology of production, and the absence of barriers to trade. Inequality of wage levels between regions within the United States may caused by some or all of these reasons.

Actually, the barriers to trade always exist in the real world due to transportation costs. And the trade between U.S. and Mexico, by contrast, is subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger.

6.Explain why the Leontief paradox and the more recent Bowen, Leamer, and

Sveikauskas results reported in the text contradict the factor-proportions theory.

The factor proportions theory states that countries export those goods whose production is intensive in factors with which they are abundantly endowed. One would expect the United States, which has a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods. Bowen, Leamer and Sveikauskas found that the correlation between factor endowment and trade patterns is weak for the world as a whole.

The data do not support the predictions of the theory that countries' exports and imports reflect the relative endowments of factors.

7.In the discussion of empirical results on the Heckscher-Ohlin model, we noted that

recent work suggests that the efficiency of factors of production seems to differ internationally. Explain how this would affect the concept of factor price equalization.

If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be more successful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled worker could earn twice what lower skilled workers do and the price of one effective unit of labor would still be equalized.

chapter 8

1. The import demand equation, MD, is found by subtracting the home supply equation from the home demand equation. This results in MD = 80 - 40 x P. Without trade, domestic prices and quantities adjust such that import demand is zero. Thus, the price in the absence of trade is

2.

2. a. Foreign's export supply curve, XS, is XS = -40 + 40 x P. In the absence of trade, the price is 1.

b. When trade occurs export supply is equal to import demand, XS = MD. Thus, using the

equations from problems 1 and 2a, P = 1.50, and the volume of trade is 20.

3. a. The new MD curve is 80 - 40 x (P+t) where t is the specific tariff rate, equal to 0.5. (Note: in solving these problems you should be careful about whether a specific tariff or ad valorem tariff is imposed. With an ad valorem tariff, the MD equation would be expressed as MD =80-40 x (1+t)P). The equation for the export supply curve by the foreign country is unchanged. Solving, we find that the world price is $1.25, and thus the internal price at home is $1.75. The volume of trade has been reduced to 10, and the total demand for wheat at home has fallen to 65 (from the free trade level of 70). The total demand for wheat in Foreign has gone up from 50 to 55.

b. and

c. The welfare of the home country is best studied using the combined numerical and

graphical solutions presented below in Figure 8-1.

P T =1.75

50556070Quantity

Price P W =1.50

P T*=1.25

where the areas in the figure are:

a: 55(1.75-1.50) -.5(55-50)(1.75-1.50)=13.125

b: .5(55-50)(1.75-1.50)=0.625

c: (65-55)(1.75-1.50)=2.50

d: .5(70-65)(1.75-1.50)=0.625

e: (65-55)(1.50-1.25)=2.50

Consumer surplus change: -(a+b+c+d)=-16.875. Producer surplus change: a=13.125. Government revenue change: c+e=5. Efficiency losses b+d are exceeded by terms of trade gain e. [Note: in the calculations for the a, b, and d areas a figure of .5 shows up. This is because we are measuring the area of a triangle, which is one-half of the area of the rectangle defined by the product of the horizontal and vertical sides.]

4. Using the same solution methodology as in problem 3, when the home country is very small relative to the foreign country, its effects on the terms of trade are expected to be much less. The small country is much more likely to be hurt by its imposition of a tariff. Indeed, this intuition is shown in this problem. The free trade equilibrium is now at the price $1.09 and the trade volume is now $36.40.

With the imposition of a tariff of 0.5 by Home, the new world price is $1.045, the internal home price is $1.545, home demand is 69.10 units, home supply is 50.90 and the volume of trade is 18.20. When Home is relatively small, the effect of a tariff on world price is smaller than when Home is relatively large. When Foreign and Home were closer in size, a tariff of .5 by home lowered world price by 25 percent, whereas in this case the same tariff lowers world price by

about 5 percent. The internal Home price is now closer to the free trade price plus t than when Home was relatively large. In this case, the government revenues from the tariff equal 9.10, the consumer surplus loss is 33.51, and the producer surplus gain is 21.089. The distortionary losses associated with the tariff (areas b+d) sum to 4.14 and the terms of trade gain (e) is 0.819. Clearly, in this small country example the distortionary losses from the tariff swamp the terms of trade gains. The general lesson is the smaller the economy, the larger the losses from a tariff since the terms of trade gains are smaller.

5. The effective rate of protection takes into consideration the costs of imported intermediate goods. In this example, half of the cost of an aircraft represents components purchased from other countries. Without the subsidy the aircraft would cost $60 million. The European value added to the aircraft is $30 million. The subsidy cuts the cost of the value added to purchasers of the airplane to $20 million. Thus, the effective rate of protection is (30 - 20)/20 = 50%.

6. We first use the foreign export supply and domestic import demand curves to determine the new world price. The foreign supply of exports curve, with a foreign subsidy of 50 percent per unit, becomes XS= -40 + 40(1+0.5) x P. The equilibrium world price is 1.2 and the internal foreign price is 1.8. The volume of trade is 32. The foreign demand and supply curves are used to determine the costs and benefits of the subsidy. Construct a diagram similar to that in the text and calculate the area of the various polygons. The government must provide (1.8 - 1.2) x 32 = 19.2 units of output to support the subsidy. Foreign producers surplus rises due to the subsidy by the amount of 15.3 units of output. Foreign consumers surplus falls due to the higher price by

7.5 units of the good. Thus, the net loss to Foreign due to the subsidy is 7.5 + 19.2 - 15.3 = 11.4 units of output. Home consumers and producers face an internal price of 1.2 as a result of the subsidy. Home consumers surplus rises by 70 x .3 + .5 (6x.3) = 21.9 while Home producers surplus falls by 44 x .3 + .5(6 x .3) = 14.1, for a net gain of 7.8 units of output.

7. At a price of $10 per bag of peanuts, Acirema imports 200 bags of peanuts. A quota limiting the import of peanuts to 50 bags has the following effects:

a. The price of peanuts rises to $20 per bag.

b. The quota rents are ($20 - $10) x 50 = $500.

c. The consumption distortion loss is .5 x 100 bags x $10 per bag = $500.

d. The production distortion loss is .5 x50 bags x$10 per bag = $250.

International Economics, 8e (Krugman) Chapter 1 Introduction 1.1 What Is International Economics About? 1) Historians of economic thought often describe ________ written by ________ and published in ________ as the first real exposition of an economic model. A) "Of the Balance of Trade," David Hume, 1776 B) "Wealth of Nations," David Hume, 1758 C) "Wealth of Nations," Adam Smith, 1758 D) "Wealth of Nations," Adam Smith, 1776 E) "Of the Balance of Trade," David Hume, 1758 Answer: E Question Status: Previous Edition 2) From 1959 to 2004, A) the U.S. economy roughly tripled in size. B) U.S. imports roughly tripled in size. C) the share of US Trade in the economy roughly tripled in size. D) U.S. Imports roughly tripled as compared to U.S. exports. E) U.S. exports roughly tripled in size. Answer: C Question Status: Previous Edition 3) The United States is less dependent on trade than most other countries because A) the United States is a relatively large country. B) the United States is a "Superpower." C) the military power of the United States makes it less dependent on anything. D) the United States invests in many other countries. E) many countries invest in the United States. Answer: A Question Status: Previous Edition 4) Ancient theories of international economics from the 18th and 19th Centuries are A) not relevant to current policy analysis. B) are only of moderate relevance in today's modern international economy. C) are highly relevant in today's modern international economy. D) are the only theories that actually relevant to modern international economy. E) are not well understood by modern mathematically oriented theorists. Answer: C Question Status: Previous Edition 5) An important insight of international trade theory is that when countries exchange goods and services one with the other it A) is always beneficial to both countries. B) is usually beneficial to both countries. C) is typically beneficial only to the low wage trade partner country. D) is typically harmful to the technologically lagging country. E) tends to create unemployment in both countries. Answer: B Question Status: Previous Edition

第1篇国际贸易理论 第2章世界贸易概览 2.1复习笔记 1.经济规模与进出口总额之间的关系 (1)规模问题:引力模型 现实证明一国的经济规模与其进出口总额息息相关。把整个世界贸易看成整体,可利用引力模型(gravity model)来预测任意两国之间的贸易规模。引力模型方程式如下: 其中, T是i国与j国的贸易额,A为常量,i Y是i国的国内生产总值,j Y是j国的国 ij 内生产总值, D是两国的距离。引力模型方程式表明:其他条件不变的情况下,两国间的 ij 贸易规模与两国的GDP成正比,与两国间的距离成反比。 (2)引力模型的内在逻辑 引力模型之所以能较好地拟合两国之间的实际贸易现状,其原因在于:大的经济体收入高,因而大量进口产品;大的经济体能生产更多品种的系列产品,因而更能满足其他国家的需求,进而大量出口产品。在两国贸易中,任一方的经济规模越大,则双方的贸易量就越大。 (3)引力模型的应用:寻找反例 当两国之间的贸易量与依照引力模型计算得出的结果相差较大时,就需要从其他因素进行分析,如文化的亲和性、地理位置、运输成本等因素。事实上,这也是引力模型的重要用

途之一,即有助于明确国际贸易中的异常现象。 (4)贸易障碍:距离、壁垒和疆界 距离、壁垒和疆界对国际贸易有负面作用,会使得两国之间的贸易额大大小于根据引力模型所计算出的结果。另外,在各国GDP和距离给定的情况下,有效贸易协定(trade agreement)比无效的贸易协定更能显著增加成员国的贸易量,这也是美国与其邻国的贸易量明显大于其和相同大小的欧盟的贸易量的原因之一。 2.正在演变的世界贸易模式 (1)世界变小了吗? 人们认为,现代化的运输和通讯可以超越空间距离的束缚,世界因此成了小“村落”。事实的确如此。但是,有时候政治的力量可以超过技术进步的作用,两次世界大战、20世纪30年代的大萧条及战后全世界范围内的贸易保护主义等都严重制约着国际贸易的发展,使得国际贸易大幅萎缩,并且用了几十年才得以恢复。 (2)交易内容 从全世界范围来看,工业制成品是主要的交换产品,所占比重最大。矿产品特别是现代世界不可或缺的石油依旧是世界贸易的主要部分。引人注目的是发展中国家已经从初级产品出口国转变为主要的制成品出口国。另外,服务贸易在国际贸易中凸显重要,并且其重要性越来越突出。 (3)服务外包 随着现代信息技术的发展和应用,一种新的贸易形式——服务外包(service outsourcing)随之出现。服务外包也称之为离岸服务,是一种新兴的国际贸易现象,使得曾经必须在一国国内实现的服务现在可以在国外实现。 (4)旧规则依然可行吗?

国际经济学克鲁格曼课后习题答案章 集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]

第一章练习与答案 1.为什么说在决定生产和消费时,相对价格比绝对价格更重要? 答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。所以,在决定生产和消费时,相对价格比绝对价格更重要。 2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。 答案提示: 3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。 答案提示: 4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。 答案提示: 5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致? 答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。 6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。 答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。 7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平? 答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些? 答案提示:小国。 9*.为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸?

〈〈国际经济学》(国际金融)习题答案要点 第12章国民收入核算与国际收支 1、如问题所述,GNP仅仅包括最终产品和服务的价值是为了避免重复计算的问题。 在国民收入账户中,如果进口的中间品价值从GNP中减去,出口的中间品价值加 到GNP中,重复计算的问题将不会发生。例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的GNP中。出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的GNP,而最终没有进入美国的国民收入账户。所以这部分由美国生产要素创造的中间品价值应该从日本的GNP中减去,并加入美国的GNP。 2、(1)等式12-2可以写成CA =(S P-I)? (T -G)。美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。 不同情况对经常账户产生不同的影响。例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。一般地,永久性和临时性的关税保护有不同的效果。这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。 3、 (1)、购买德国股票反映在美国金融项目的借方。相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。这是美国用一个外国资产交易另外一种外国资产的案例。 (2)、同样,购买德国股票反映在美国金融项目的借方。当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷 方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。最后,银行采取的各项行为将导致记入美国国际收支表的贷方。 (3)、法国政府通过销售其持有在美国银行的美元存款干预外汇市场,代表美国金融项目的借方项目。购买美元的法国公民如果使用它们购买美国商品,这将记入美国国际收支账户经常项目的贷方;如果用来购买美国资产,这将记入美国国际收支账户金融项目的贷方。 (4)假定签发旅行支票的公司使用支票账户在法国进行支付。当此公司支付餐费给 法国餐馆时,记入美国经常项目的借方。签发旅行支票的公司必须销售资产(消耗 其在法国的支票账户)来支付,从而减少了公司在法国拥有的资产,这记入美国金融项目的贷方。 (5)、没有市场交易发生。 (6)离岸交易不影响美国国际收支账户。 4、购买answering machine记入New York收支账户的经常项目借方,记入New Jersey 收支账户经常项目的贷方。当New Jersey的公司将货款存入New York银行时,记入New York的金融项目的贷方和New Jersey金融项目的借方。如果交易用现金进 行支付,则记入New Jersey金融项目的借方和New York金融项目的贷方。New Jersey 获得美元现钞(从New York进口资产),而New York则减少了美元(出口美元资产)。最后的调整类似于金本位制下发生的情况。5、

绝对优势:是指以各国生产成本的绝对差异为基础进行的国际专业化分工,并通过自由贸易获得利益的一种国际贸易理论。 李嘉图模型:是一个单一要素模型,劳动是唯一的生产要素,劳动生产率的差异是不同国家各个产业部门之间唯一的不同之处,也是决定国际贸易的唯一因素。李嘉图模型的中心含义是如果每个国家都能够专门生产并出口本国劳动生产率较高的产品,那么他们之间的贸易就会给每个国家带来利益,他的两个核心含义:劳动生产率的差异在国际贸易中占据重要地位和贸易模式取决于比较优势而非绝对优势,至今仍能得到事实支持。 机会成本:是指因一种选择而放弃的最有替换物或失去最好机会的价值,即是指经济决策中影由中选的最优方案负担的,按所放弃的次优方案潜在收益计算的那部分资源损失。 要素比例理论/赫克歇尔俄林理论:是指从资源禀赋角度对国际贸易中的生产成本和价格的差异做出解释的国际贸易理论。其内容是:各国的贸易源于不同国家之间商品的价格存在差异,而价格差异的原因在于不同国家之间的生产成本有高有低,生产成本的高低是因为各国生产要素价格有差别,生产要素价格的差异又与各国生产要素丰裕程度密切相关。生产要素丰裕,其商品价格自认就相对低一些,生产要素稀缺,其价格相对高一些。生产要素丰裕度的差异是国际贸易产生的根本原因。 出口偏向性增长:是指一国的经济增长主要源于出口产品生产能力提高的经济增长方式,表现在生产可能性边界上就是使生产可能性边界扩张偏向出口产品。 福利恶化性增长:是指一国整体福利水平恶化的经济增长方式,是发展中国家的出口偏向型增长在严格假定下可能出现的一种极端情况。一国的出口偏向性增长可能导致该国的贸易条件恶化。因此,如果一国的经济增长方式表现为极强的出口偏向性,那么贸易条件恶化带来的负面影响就会抵消生产力提高带来的正面效应,使得该国整体的福利水平恶化。 出口补贴:是指国家为了降低出口商品的价格,提高其在国际上的竞争力,对出口商品给予的现金或财政上的补贴。 动态收益递增:成本随着累计产量下降而并非随着当前劳动生产率的上升而下降的情形就是动态收益递增 倾销:出口商以低于国内市场价格的价格,甚至以低于成本的价格在国际市场上销售商品的行为。 外部规模经济是指整个行业规模和产量的扩大而使单个企业平均成本下降或收益增加的经济现象。 边际收益:在生产的技术水平和其他投入要素的数量均保持不变情况下,新增加一个单位的某种投入要素所引起的产量的增加量。 幼稚工业论:认为新兴工业在发展初期需要国家提供保护以免在外国强大的竞争下夭折,并随着新兴工业的发展和竞争力的增强而逐步取消贸易保护,为自由贸易的实行创造条件。垄断竞争:介于完全竞争和完全垄断之间的一种市场结构,这种结构下既存在垄断,又存在竞争。 价格歧视:一家企业在销售同样的商品时,对不同的顾客索取不同价格的做法 完全垄断:完全排斥竞争的一种市场结构。 内部规模经济:单个企业生产规模不断扩大时,由其自身内部引起的平均成本不断下降,收益不断增加的经济现象。 相互倾销:不同国家生产同种或类似产品的厂商都对出口产品制定一个低于国内市场价的价格并进行双向贸易的现象。 行业内贸易:在国际贸易活动中,不同国家之间就同一产业的产品所进行的贸易。

克鲁格曼《国际经济学》中文版·第九版课后习题答案 第一章练习与答案 1.为什么说在决定生产和消费时,相对价格比绝对价格更重要? 答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。所以,在决定生产和消费时,相对价格比绝对价格更重要。 2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。 答案提示: 3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡? 试解释原因。 答案提示: 4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。 答案提示: 5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致? 答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。 6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。 答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。 7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平? 答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。 8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些? 答案提示:小国。 9*.为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸? 答案提示: 第二章答案 1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

中南财经政法大学——学年第—-学期期末考试试卷 国际经济学(闭卷)卷 学院专业年级班级课堂号姓名 (单选,共20题,每题2分) 1, Under Ricardian model, If one country's wage level is very high relative to the other's (the relative wage exceeding the relative productivity ratios), then ( ) A.it is not possible that producers in each will find export markets profitable. B.it is not possible that consumers in both countries will enhance their respective welfares through imports. C.it is not possible that both countries will find gains from trade. D.it is possible that both will enjoy the conventional gains from trade. 2, According to Ricardo, a country will have a comparative advantage in the product in which its ( ) https://www.doczj.com/doc/417628987.html,bor productivity is relatively low. https://www.doczj.com/doc/417628987.html,bor productivity is relatively high. https://www.doczj.com/doc/417628987.html,bor mobility is relatively low. https://www.doczj.com/doc/417628987.html,bor mobility is relatively high. 3, If Australia has more land per worker, and Belgium has more capital per worker, then if trade were to open up between these two countries, ( ) A.Australia would export the land-intensive product. B.Belgium would import the capital-intensive product. C.Both countries would export some of each product. D.Trade would not continue since Belgium is a smaller country. 4, Under The Specific Factors model, At the production point the production possibility frontier is tangent to a line whose slope is ( ) A.the price of manufactures. B.the relative wage. C.the real wage. D.the relative price of manufactures. 5, The Heckscher-Ohlin model predicts all of the following except: A.which country will export which product. ( ) B.which factor of production within each country will gain from trade. C.the volume of trade. D.that wages will tend to become equal in both trading countries.

Chapter 1 Introduction ?Chapter Organization What Is International Economics About? The Gains from Trade The Pattern of Trade How Much Trade? Balance of Payments Exchange Rate Determination International Policy Coordination The International Capital Market International Economics: Trade and Money ?Chapter Overview The intent of this chapter is to provide both an overview of the subject matter of international economics and to provide a guide to the organization of the text. It is relatively easy for an instructor to motivate the study of international trade and finance. The front pages of newspapers, the covers of magazines, and the lead reports on television news broadcasts herald the interdependence of the U.S. economy with the rest of the world. This interdependence may also be recognized by students through their purchases of imports of all sorts of goods, their personal observations of the effects of dislocations due to international competition, and their experience through travel abroad. The study of the theory of international economics generates an understanding of many key events that shape our domestic and international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexican crisis in late 1994; and the increased pressures for industry protection against foreign competition broadly voiced in the late 1980s and more vocally espoused in the first half of the 1990s. The financial crisis that began in East Asia in 1997 and spread to many countries around the globe and the Economic and Monetary Union in Europe highlighted the way in which various national economies are linked and how important it is for us to understand these connections. These global linkages have been highlighted yet again with the rapid spread of the financial crisis in the United States to the rest of the world. At the same time, protests at global economic meetings and a rising wave of protectionist rhetoric have highlighted opposition to globalization. The text material will enable students to understand the economic context in which such events occur. ? 2012 Pearson Education, Inc. Publishing as Addison-Wesley

克鲁格曼国际经济学课 后答案英语版 Company Document number:WUUT-WUUY-WBBGB-BWYTT-1982GT

C H A P T E R 2 LABOR PRODUCTIVITY AN D COMPARATIV E ADVANTAGE: THE RICARDIAN MODEL ANSWERS TO TEXTBOOK PROBLEMS 1. a. The production possibility curve is a straight line that intercepts the apple axis at 400 (1200/3) and the banana axis at 600 (1200/2). b. The opportunity cost of apples in terms of bananas is 3/2. It takes three units of labor to harvest an apple but only two units of labor to harvest a banana. If one foregoes harvesting an apple, this frees up three units of labor. These 3 units of labor could then be used to harvest bananas. c. Labor mobility ensures a common wage in each sector and competition ensures the price of goods equals their cost of production. Thus, the relative price equals the relative costs, which equals the wage times the unit labor requirement for apples divided by the wage times the unit labor requirement for bananas. Since wages are equal across sectors, the price ratio equals the ratio of the unit labor requirement, which is 3 apples per 2 bananas. 2. a. The production possibility curve is linear, with the intercept on the apple axis equal to 160 (800/5) and the intercept on the banana axis equal to 800 (800/1). b. The world relative supply curve is constructed by determining the supply of apples relative to the supply of bananas at each relative price. The lowest relative price at which apples are harvested is 3 apples per 2 bananas. The relative supply curve is flat at this price. The maximum number of apples supplied at the price of 3/2 is 400 supplied by Home while, at this price, Foreign harvests 800 bananas and no apples, giving a maximum relative supply at this price of 1/2. This relative supply holds for any price between 3/2 and 5. At the price of 5, both countries would harvest apples. The relative supply curve is again flat at 5. Thus, the relative supply curve is step shaped, flat at the price 3/2 from the relative supply of 0 to 1/2, vertical at the relative quantity 1/2 rising from 3/2 to 5, and then flat again from 1/2 to infinity. 3. a. The relative demand curve includes the points (1/5, 5), (1/2, 2), (1,1), (2,1/2). b. The equilibrium relative price of apples is found at the intersection of the relative demand and relative supply curves. This is the point (1/2, 2), where the relative demand curve intersects the vertical section of the relative supply curve. Thus the equilibrium relative price is 2. c. Home produces only apples, Foreign produces only bananas, and each country trades some of its product for the product of the other country. d. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one apple foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. Each country is better off with trade. 4. The increase in the number of workers at Home shifts out the relative supply schedule such that the corner points are at (1, 3/2) and (1, 5) instead of (1/2, 3/2) and (1/2, 5). The intersection of the relative demand and relative supply curves is now in the lower horizontal section, at the point (2/3, 3/2). In this case, Foreign still gains from trade but the opportunity cost of bananas in terms of apples for Home is the same whether or not there is trade, so Home neither gains nor loses from trade.

第9章贸易政策中的政治经济学 一、概念题 1.约束(binding) 答:在国际贸易中,约束一般是指税率的约束,即“约束”关税的税率。约束税率是指经过谈判达成协议而固定下来的关税税率。按关贸总协定规定,缔约各国应该在互惠互利的基础上通过有选择的产品对产品的方式,或者为有关缔约国所接受的多边的程序进行谈判,谈判结果固定下来的各国税则商品的税率为约束税率,汇总起来形成减让表,作为总协定的一个附属部分付诸实施。按关贸总协定规定,关税减让谈判有四种减让形式来约束关税的税率:①降低关税并约束在降低了的关税水平;②约束现行关税税率;③约束在现行关税水平以上的某个关税水平;④约束免税待遇。 2.支持自由贸易的政治依据(political argument for free trade) 答:支持自由贸易的政治依据是指,尽管理论上可能还有比自由贸易更好的政策,但从政治上认可和支持自由贸易的原则更重要。现实中的贸易政策经常会由具有特殊利益关系的集团所左右,而不考虑国家的成本与收益。虽然从理论上可以证明某些选择性的关税和出口补贴政策能够增进整体社会福利,但现实中,任何一个政府机构在制定一套干预贸易的详细计划时都有可能被利益集团所控制,从而成为在有政治影响的部门中进行收入再分配的工具。如果上述观点正确的话,那么倡导自由贸易无疑是最好的选择。 3.集体行动(collective action) 答:集体行动是指关于经济活动中个人理性并不必然导致集体理性。如果某项活动或者

福利的获得需要两个或者两个以上的人的共同努力才能完成,集体行动问题就出现了,即决策集体的每个成员必须单方面决定是否参与提供某种集体产品。因为集体产品具有非排他性和非竞争性的特征,所以使得不为集体产品的提供付出成本的集团成员也可以获得集体产品。集团越大,分享收益的人越多,个人的行动对集团利益的影响越小,集团内的成员“搭便车”的动机就越强烈。这就意味着仅仅依靠个人的自愿,集体产品的供给将是不足的,集体产品不可能依靠个人的自愿提供来解决。因此,个人理性并不必然导致集体理性,个人理性不是实现集体理性的充分条件。 4.特惠贸易协定(preferential trading agreement) 答:特惠贸易协定是指各签约方之间相互减让关税或实行其他贸易优惠措施,但不将其给予非签约方的贸易优惠协定。由于这种协定违反了最惠国待遇原则,因而一般被世界贸易组织所禁止。但是,如果它能够促进签约方之间的自由贸易,那么世界贸易组织就允许其存在。如下两种方式的特惠贸易协定是世界贸易组织允许的: (1)自由贸易区,各签约方设立对外关税率,但相互之间免除关税和取消非关税壁垒; (2)关税同盟,各成员国制定统一的对外关税率,而成员国之间则是“特惠”的。 5.关税同盟(customs union) 答:关税同盟是指两个或两个以上参加同盟的国家划为一个关税区域,在区域内取消关税和非关税壁垒,实行自由贸易,同时对区域外采取统一的关税及其他贸易限制等措施。关税同盟是跨国区域经济一体化的一种基本形式。关税同盟可以分为完全关税同盟和不完全关税同盟。完全关税同盟是指将各加盟国的关税完全废除,这种关税同盟按惯例不受最惠国待遇原则的约束。但事实上,当关税同盟成立时,各国原有的关税并不能立即完全废除,为避

国际经济学双语习题 3 International Economics, 8e (Krugman) Chapter 3 Labor Productivity and Comparative Advantage: The Ricardian Model 3.1 The Concept of Comparative Advantage 1) Trade between two countries can benefit both countries if A) each country exports that good in which it has a comparative advantage. B) each country enjoys superior terms of trade. C) each country has a more elastic demand for the imported goods. D) each country has a more elastic supply for the exported goods. E) Both C and D. Answe r: A

Question Previous Edition Status: 2) In order to know whether a country has a comparative advantage in the production of one particular product we need information on at least ________ unit labor requirements one A) two B) three C) four D) five E) Answe D r: Previous Edition Question Status: 3) A country engaging in trade according to the principles of comparative advantage gains from trade because it is producing exports indirectly more efficiently than it A) could alternatively. is producing imports indirectly more efficiently than it B) could domestically. is producing exports using fewer labor units. C) is producing imports indirectly using fewer labor units. D) None of the above. E) B Answe r: Previous Edition Question Status: